You don’ ’t have to formally turn into the “ investor ” to spend in the stock exchange — mostly , it’s welcome anyone. And after you get the initial assets, you’ll join the ranks of investors in the globe who are using the stock exchange to create long-term wealth. But before you do that, it’s important to see what the stock exchange is, how it works and a couple of basic investment schemes. The term “ stock exchange ” frequently relates to one of the leading stock exchange indices, , e.g., the Dow Jones Industrial statistic or the S& P 500. Because it’s difficult to make every single product, these indicators include the portion of the stock exchange and their performance is regarded as representative of the whole industry.

Putting your money in the stock market has the potential to generate decent returns, especially if you invest wisely. However, the stock market can experience both large and small fluctuations in value. While there is an opportunity see big returns, it may be just as likely to see big losses too. If you decide to invest in the stock market, make sure you spread your money across different industries to diversify your portfolio and minimize risk as much as possible. REITs have been growing in popularity for awhile now. Real estate trusts allow people to invest in real estate, without actually buying a rental property. Instead, investors may buy into bigger real estate projects and own equity in the project as a whole. This is a great way to get into real estate investing, without having to fork over a ton of cash.

Additionally, many choose to invest via passive index funds. In this method, one holds a portfolio of the entire stock market or some segment of the stock market (such as the S&P 500 Index or Wilshire 5000). The principal aim of this strategy is to maximize diversification, minimize taxes from realizing gains, and ride the general trend of the stock market to rise.

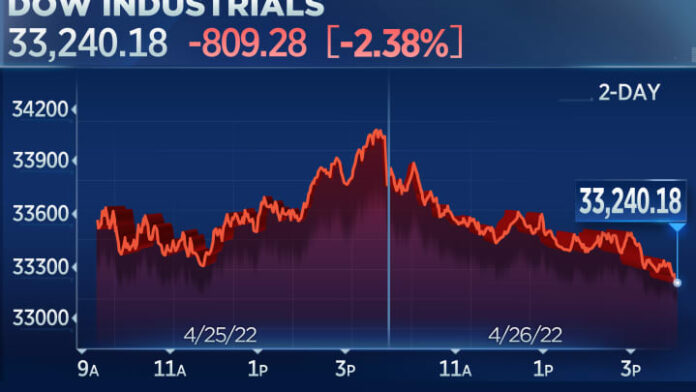

You might see a news headline that says the stock market has moved lower, or that the stock market closed up or down for the day. Most often, this means stock market indexes have moved up or down, meaning the stocks within the index have either gained or lost value as a whole. Investors who buy and sell stocks hope to turn a profit through this movement in stock prices.

A stock market crash is often defined as a sharp dip in share prices of stocks listed on the stock exchanges. In parallel with various economic factors, a reason for stock market crashes is also due to panic and investing public’s loss of confidence. Often, stock market crashes end speculative economic bubbles. There have been famous stock market crashes that have ended in the loss of billions of dollars and wealth destruction on a massive scale.

The term “stock market” often refers to one of the major stock market indexes, such as the Dow Jones Industrial Average or the S&P 500. Because it’s hard to track every single stock, these indexes include a section of the stock market and their performance is viewed as representative of the entire market. You might see a news headline that says the stock market has moved lower, or that the stock market closed up or down for the day. Most often, this means stock market indexes have moved up or down, meaning the stocks within the index have either gained or lost value as a whole.

A market index is a popular measure of stock market performance. Most market indices are market-cap weighted—which means that the weight of each index constituent is proportional to its market capitalization—although a few like the Dow Jones Industrial Average (DJIA) are price-weighted. In addition to the DJIA, other widely watched indices in the U.S. and internationally include: